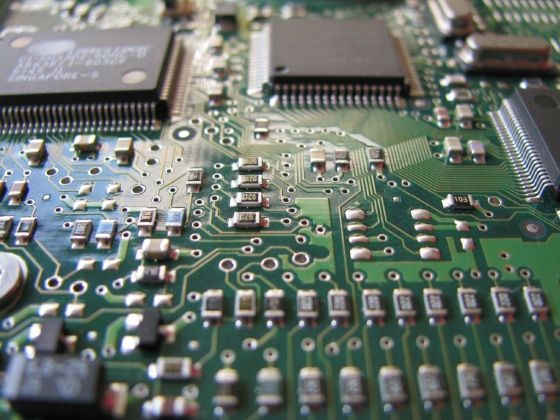

A global shortage of semiconductors – items increasingly used in cars, smartphones, video consoles, TVs and other electrical items – is impacting on production

lines internationally.

Nissan’s UK Sunderland car factory temporarily furloughed 750 workers from its Juke and Qashqai production lines earlier this year, with the firm blaming the scarcity of semiconductor parts. It’s the latest in a long line of car factories that have reduced production specifically due to the shortage, including US car giant Ford. Automotive groups are thought to be suffering the most from the shortfall, which is being exacerbated by growing demand from a variety of industries.

Semiconductor‐hungry 5G‐ready smartphones and a rise in sales of items like home computers and laptops during the numerous Covid‐related lockdowns have further increased demands on the sector. Lockdowns back in early 2020 affected production, which since resuming has been struggling to keep up.

The semiconductor sector was placed under further pressure when significant supplier Renesas suffered a fire on 19 March in one of its subsidiaries in Japan, effectively shutting production. The firm estimates the factory will be back to 100% only by the end of May.

While mothballed production lines awaiting semiconductors have obvious implications for suppliers of industrial fasteners to the automotive and electrical sectors, increasingly advanced power tools used by professional end users and DIYers are also expected to be impacted by the paucity of semiconductors. For power tools that use semiconductors as well as batteries using the increasingly in‐demand Li‐ion, shortages look likely to persist in the market.

With just a few countries responsible for the world’s supply of semiconductors, added to the growth in demand and also geopolitical risks, the likes of the European Commission have formed plans to double the EU’s share in global production of semiconductors as part of its ‘Digital Decade’.

This article originally appeared in the April 2021 issue of Torque Magazine, which you can read in its entirety online. If you are part of the fastener, tool and related industries you can subscribe to the magazine or sign up to our weekly newsletter.