Improving maritime trade tracking and forecasting is one of the measures required to avert a repeat of the current shipping container crisis, according to the United Nations Conference on Trade and Development (UNCTAD).

The worldwide container crisis has disrupted the supply chain for most sectors. The pressure on freight and imports - exacerbated when the huge container ship Ever Given blocked the Suez Canal for six days in March - has led to product shortages, not least in the fastener, fixing and tool industries. The situation has left wholesalers and distributors struggling to keep up with demand in buoyant sectors, like construction.

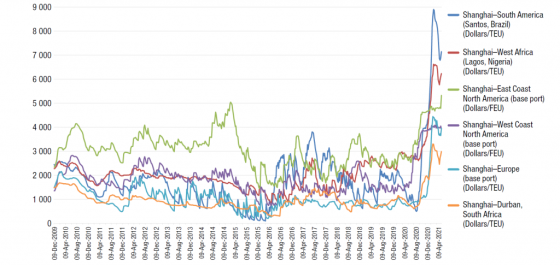

Spiralling shipping costs have been felt in many nations, with developing regions bearing the brunt, for a number of reasons - rates to South America and western Africa are higher than any other major trade region. By early 2021, freight rates from China to South America rocketed 443%, compared with 63% on the route from Asia to North America's eastern coast.

Container crisis: 3 issues that need attention

UNCTAD's new policy brief, which has examined the causes of the container freight crisis, sees the advancement of trade facilitation reforms, improving maritime trade tracking and forecasting and strengthening of national competition authorities as factors required to avoid a similar situation reoccurring.

First, policymakers need to implement reforms to make trade easier and less costly, many of which are enshrined in the World Trade Organization’s Trade Facilitation Agreement. By reducing physical contact between workers in the shipping industry, such reforms, which rely on modernising trade procedures, would also make supply chains more resilient and protect employees better, UNCTAD said.

Shortly after COVID-19 struck, UNCTAD provided a 10-point action plan to keep ships moving, ports open and trade flowing during the pandemic. The organisation has also joined forces with the UN’s regional commissions to help developing countries fast-track such reforms and tackle trade and transport challenges made evident by the pandemic.

UNCTAD said that policymakers need to promote transparency and encourage collaboration along the maritime supply chain to improve how port calls and liner schedules are monitored.

Governments must also ensure competition authorities have the resources and expertise needed to investigate potentially abusive practices in the shipping industry.

Although the pandemic’s disruptive nature is at the core of the container shortage, certain strategies by carriers may have delayed the repositioning of containers at the beginning of the crisis.

Providing the necessary oversight is more challenging for authorities in developing countries, who often lack resources and expertise in international container shipping, the organisation added.

The causes of the container crisis

The pace of recovery in demand after Covid-19 first hit is partly to blame for disruption.

“Changes in consumption and shopping patterns triggered by the pandemic, including a surge in electronic commerce, as well as lockdown measures, have in fact led to increased import demand for manufactured consumer goods, a large part of which is moved in shipping containers,” the UNCTAD policy brief says.

Maritime trade flows further increased as some governments eased lockdowns and approved national stimulus packages, and businesses stocked up in anticipation of new waves of the pandemic.

“The increase in demand was stronger than expected and not met with a sufficient supply of shipping capacity,” the UNCTAD policy brief says, adding that the subsequent shortage of empty containers “is unprecedented.”

“Carriers, ports and shippers were all taken by surprise,” it says. “Empty boxes were left in places where they were not needed, and repositioning had not been planned for.”

The underlying causes are complex and include changing trade patterns and imbalances, capacity management by carriers at the beginning of the crisis and ongoing COVID-19-related delays in transport connection points, such as ports.

Are you in the fastener, tool, fixing or related industries? You can subscribe to Torque Magazine or sign up to our weekly newsletter.