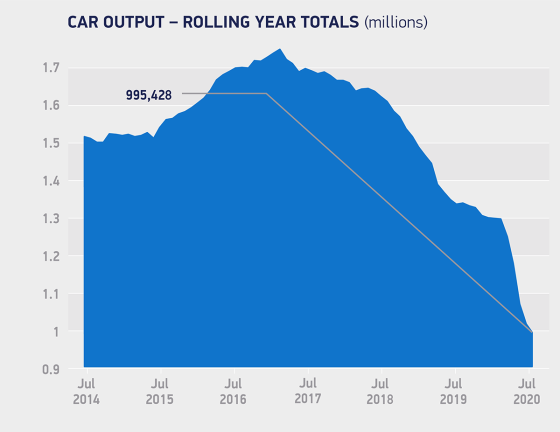

UK car manufacturing output fell -20.8% in July as 85,696 units rolled off production lines, according to figures released this morning by the Society of Motor Manufacturers and Traders (SMMT).

While July saw car production continue to ramp up as global lockdown measures eased - nearly all factories are now reportedly open - the SMMT found that social distancing measures and ongoing economic uncertainty continue to stifle output.

In the year to date, the impact of the pandemic on key markets, including the UK, means that overall production remains down -39.7%, a year-on-year loss of 307,707 cars.

Overseas shipments in the first seven months are now down -38.5% to 381,273 units, with production for the UK market falling -44.5% to 85,780.

Like the UK's car factories, almost all UK car showrooms were able to open throughout July. Production for the UK market improved compared with May and June. However, it still fell by a dramatic -37.1% year-on-year, with just 13,434 units leaving factory gates.

Manufacturing for export also fell, but by a slightly less substantial -16.8% to total 72,262 units. Exports accounted for more than eight out of 10 vehicles built in July with buyers in overseas markets, including the EU, China and the US, attracted to the latest cutting-edge UK-built models, said the SMMT.

Other key fastener markets, like the construction sector, also saw improvements over the past two months as lockdowns have eased. However the automotive sector particularly is eyeing further challenges ahead, including recession and the potential of a no deal Brexit.

“As key global markets continue to re-open and UK car plants gradually get back to business, these figures are a marked improvement on the previous three months, but the outlook remains deeply uncertain," said Mike Hawes, SMMT Chief Executive. "With the sector now battling economic recession as well as a global pandemic, it has neither the time nor capacity to deal with the further shock of a ‘no deal’ Brexit. The impact of tariffs on the sector and the hundreds of thousands of livelihoods it supports would be devastating, so we need negotiators on both sides to pull out all of the stops to ensure a comprehensive free trade deal is agreed and in place before the end of 2020.”

According to the European Automobile Manufacturers Association (ACEA), EU-wide production losses - due to factory shutdowns - amounted to at least 2.4 million vehicles as at 1 June 2020. The average shutdown duration was 30 working days at the tine. The ACEA has predicted a contraction in car sales in 2020 of 25%.